The Future of 3D Scanning: Predictions for 2021 and Beyond

This article was originally published in the Construction Executive by John Brown

2020 was a year of disruption. The global COVID-19 pandemic forced stakeholders in every industry to think differently, and construction was no exception. As many analysts have acknowledged, the pandemic’s disruption caused a digital transformation across the industry. Decision-makers had to seriously consider new tools and practices to maintain day to day operations, one of these being scanning.

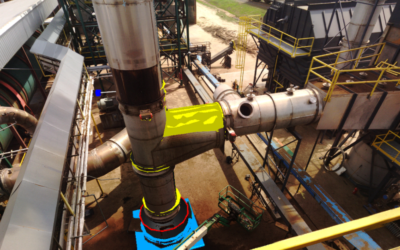

3D scanners combine advanced photogrammetry and laser technology to create an exact photo-realistic digital twin of a designated area. Whether handheld or attached to a tripod, scanners quickly capture the tiniest details of a construction site. While the scanner does not lie, it cannot see through walls and needs the correct position to capture information. The data captured is processed and held within what is sometimes called a “point cloud.” Scan data is used in many ways but essentially it serves as a record or timestamp of a particular moment on the site.

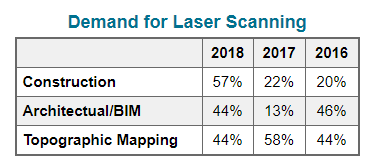

As reported by Global Market Insights, scanning had little market share in 2016, holding a small 20%. By 2018, this number grew to 57%. Although construction experienced an economic downturn this past year, many unfamiliar with scanning began using it for the first time as remote capabilities were no longer a nice to have. Although it has yet to be confirmed, it is speculated that this expansion in awareness likely drove market growth. As 2021 begins, there are five possible ways the 3D scanning market could grow and change this year and beyond.

1. An Influx of Adaptive Reuse and Renovation Projects Will Increase Scanning Use

When America’s stay-at-home orders went into place, about half of the US workforce began working remotely. This dramatic social experiment caused many to question the purpose of office buildings. In an interview with Fox Business, U.S. Housing and Urban Development Secretary Ben Carson encouraged cities to begin considering vacant office spaces for affordable housing. “Virtually all of the major cities have significant spaces that can be used, and we’re encouraging [city officials] in their planning now . . . to begin to take this into consideration.” As working from home continues to prove a successful strategy, urban planners have begun to predict possible large-scale adaptive reuse.

In metropolitan areas, where adaptive reuse is already a trend, 3D scanning has demonstrated value. Documentation for these types of buildings is typically out of date or hard to find. Understandably, this causes difficulties for architects trying to plan out new designs. Using a scanner to create up-to-date as-built documentation of the building makes the design process simple and prevents costly errors that result from incorrect information. The pressure of increased adaptive reuse projects and the need for up-to-date documentation could encourage more widespread use of scanning.

2. Scanning Becomes Part of the Estimating Process

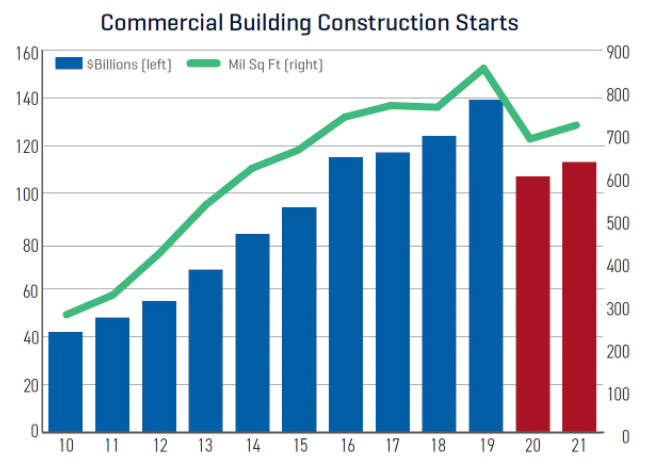

According to Dodge Data & Analytics, construction suffered a blow at the beginning of 2020 and lost 14% of project starts. According to Chief Economist Richard Branch, the industry will regain 4% of the loss at the beginning of 2021, but recovery will be slow. Likely, this will limit the amount of work available and place pressure on companies to work efficiently and effectively. The role of accurate estimating will become paramount as margins tighten.

Estimating, while less glamorous, is one of the most critical components of the project lifecycle. Improper estimating has a direct effect on the financial health of the construction project. Especially for renovation projects, scanning could assist with the accuracy of this process. Scanning would provide valuable detail to estimators trying to project timelines, understand the context of the site, and evaluate labor costs.

Having a digital twin could also help estimators communicate their assessments. Having a real-world model to annotate and discuss would give both sides of the contract agreement the clarity to analyze costs and reach a winning scenario.

3. Scanning for Safety Compliance Grabs Market Share

As construction teams navigated how to adapt to the COVID-19 crisis, new solutions emerged, demonstrating industry resilience. To assist with the new PPE and COVID-19 safety regulations, some construction technology startups developed solutions that merged photogrammetry with machine learning to monitor compliance. As scanners become more mobile and autonomous, like the Boston Dynamic’s Spot, it is conceivable that they would also include the same pattern recognition capabilities. Combined with the increased need for safety audits, this could allow scanning for safety to become a market.

Already scanning is used to validate construction progress. While initially thought of for quality assurance, it has also proven useful for safety. A slight error that is left unnoticed and built upon can turn into a structural issue and eventually a safety hazard. Progress monitoring with a 3D scanner makes sure that the building is sound. In the future, autonomous scanners evaluating progress and capable of advanced pattern recognition could recognize violations and make sure safety issues are fixed.

4. As the Need for Remote Capabilities Continues, Scanning for New Construction Will Grow

The pressure of COVID-19 and the need to have remote capabilities heightened the awareness of 3D scanning. While the technology’s value was quickly realized on renovation and adaptive reuse projects, scanning for new construction has been slower to pick up traction. As the pandemic continues to put pressure on remote coordination capabilities, scanning for new construction will likely grow if the overall market continues to expand.

Scanning for renovations and adaptive reuse proved early value because it provided architects with an easy way to capture up-to-date as-built documentation. On a new construction project, updated as-builts are unnecessary because the build starts from a clean slate. However, this can quickly change with compounding error.

Compounding error is a risk, particularly on large scale new construction projects, where a 1/16 of an inch off can turn into a full inch later as the build continues. Even if the design is perfect, the unfortunate fact is that human error is always a possibility, if not likely. 3D scanning proves its value throughout new construction projects by catching human error before they build on one another. By verifying the site with a 3D scanner, stakeholders can spot and correct these honest mistakes.

5. Smartphones Will Accelerate Scanning Adoption and the Digital Transformation of Construction

Smartphones have already transformed construction sites into connected IoT ecosystems. Today, handheld smart devices are relied upon for rapid decision making. With smartphone cameras and video conferencing apps, teams in the office and onsite have access to the same information in a couple of seconds.

Recently Apple released the Lidar-capable iPhone 12. With this new smart device, users with no previous scanning experience can create digital twins of rooms and objects. While the scanning market has grown significantly in the past decade, the technology’s value has been mostly realized by contractors participating in large-scale, metropolitan projects. Many decision-makers have yet to perceive its value. The addition of smartphone scanning capabilities is an educational opportunity for contractors of all sizes.

More than just an educational opportunity, there is potential for smartphone scanners to create Revit models of the site. Imagine creating a walkthrough or clash detecting with the iPhone camera. Having this level of information so easily accessible would democratize data across the construction lifecycle and likely increase collaboration.

In an April 2020 post, Buildots’ Roy Danon reflected, “Times of crisis often lead to creative breakthroughs and advancements, as people are forced to think differently and adopt new ways of doing the same things they have been undertaking for a long time.” While many fear the uncertainty of 2021 and stakeholders continue to navigate the ramifications of the global pandemic, the industry will continue to demonstrate resiliency and innovate forward.